Ratings of Insurance Companies in the USA

Sorting through dozens of insurers can be overwhelming—recently, I compared quotes in three states and discovered major differences in customer service and pricing. These ratings of home and auto insurance companies in the U.S. highlight who delivers top-notch claims handling, financial stability, and satisfaction so you can narrow your search quickly.

Get Personalized Insurance Quotes

Use our tools to compare live home and auto insurance quotes from leading providers. Enter your ZIP code to see rates tailored to your neighborhood’s risk profile and available discounts.

Compare Auto Insurance Rates

Instantly compare top-rated auto insurers in your area.

Compare Home Insurance Rates

Find tailored home insurance deals and customer satisfaction scores.

One important thing to remember is that “best-rated” can mean different things depending on what you value most. Some companies shine in claim responsiveness and support, while others score higher for long-term pricing stability or digital convenience. When you read ratings, look for patterns across multiple categories rather than relying on a single overall score.

For the most useful comparison, match insurers on the same coverage limits, deductibles, and optional add-ons, then compare both price and service factors side by side. This approach helps you avoid “cheap-but-thin” policies and makes it easier to spot real value—especially if you’re bundling home and auto or shopping in a new ZIP code. As one extra benchmark, you can also review Amica insurance quote options.

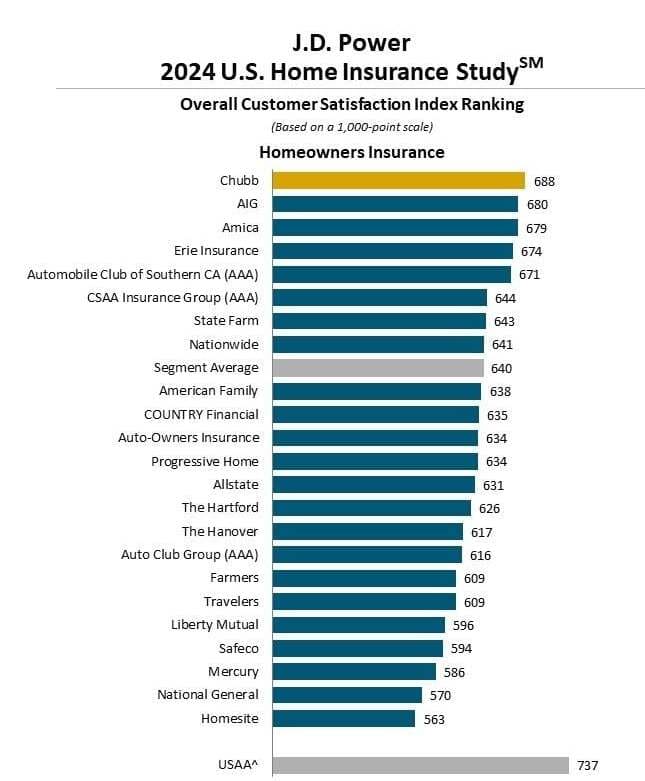

Top Home Insurance Satisfaction (2024)

In 2024 surveys by J.D. Power, Amica and Chubb topped the charts for homeowners, thanks to responsive claims processing and transparent policies. Their financial ratings (A+ from AM Best) underscore their ability to pay claims when it matters most.

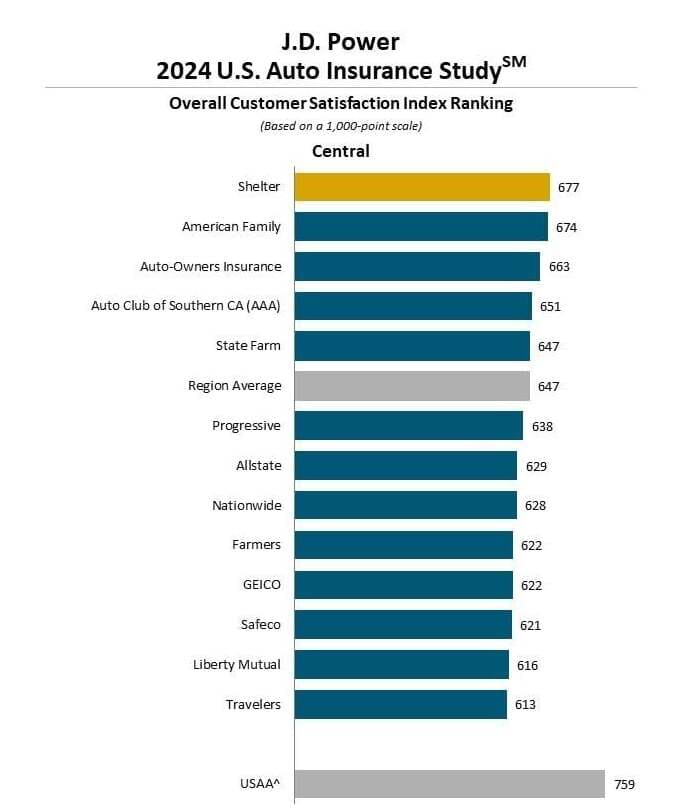

Top Auto Insurance Satisfaction (2024)

On the auto side, NJM Insurance and Amica led customer satisfaction indexes, with users praising easy claims apps and minimal rate increases after first renewals. Both maintain strong financial footing (A from AM Best) and offer competitive rates nationwide.

How Ratings Impact Your Choice

Industry ratings aggregate data on financial health, customer feedback, and claim turn-around times. Choosing a highly rated insurer means fewer headaches when filing a claim and greater peace of mind about your coverage.

Before you sign up, consider both national giants and regional carriers. Sometimes a smaller company excels locally by offering faster service and personalized attention.

2025 Insurance Trends & What to Watch

As we move into 2025, customization and digital service channels are driving ratings. Insurers that offer seamless mobile claims, usage-based discounts (like Progressive’s Snapshot), and 24/7 virtual support are edging ahead in customer satisfaction. If you want a quick example of a digital-first quoting experience, you can compare options with GEICO online home insurance quotes.

Keep an eye on emerging players focused on tech-driven underwriting. Their lean operations can translate into lower premiums for safe drivers and well-maintained homes.

The practical takeaway is simple: when you compare quotes, don’t just compare the price—compare the tools and flexibility behind it. A slightly higher premium can be worth it if the insurer offers faster claims, clearer policy controls, and discounts that fit your real behavior (mileage, payment habits, home security upgrades). Reviewing your options once a year helps you catch new savings opportunities before renewal locks in.

2026 Outlook: Smarter Pricing, Faster Claims, More Personalization

In 2026, the biggest difference between insurers will often be how precisely they price risk and how quickly they can verify information. Expect more “dynamic” quoting where discounts, deductibles, and optional coverages update in real time as you adjust details like mileage, garaging address, security devices, and payment method. For shoppers, this means small inputs matter even more—so accuracy during the quote process becomes a real money-saver.

It’s also a good year to watch how carriers handle claim speed and transparency. Companies investing in digital-first claims (photo estimates, app-based updates, faster payouts) are likely to win on customer experience, while traditional insurers will compete by expanding support options and sharpening bundle value. The best strategy is to re-shop before renewal, keep coverage limits consistent for a fair comparison, and use a trusted benchmark like compare cheap homeowners insurance quotes before you fine-tune deductibles and add-ons to match your budget.

Making the Smart Choice

Start by shortlisting insurers that score highly in both financial strength and customer service. Run personalized quotes to see exact premiums for your ZIP code—don’t rely on generic averages. Balance price with rating to find coverage that’s both affordable and reliable.

Revisit your choice annually. Ratings and rates shift as companies innovate or adjust to market conditions. A quick renewal quote comparison can uncover fresh savings and better service options.

FAQ

Q: Which home insurers topped 2024 ratings?

A: Amica and Chubb led homeowner satisfaction for responsive claims service and strong financial ratings.

Q: Who are the best auto insurers by satisfaction?

A: NJM Insurance and Amica scored highest in auto customer satisfaction, praised for smooth claims and stable rates.

Q: How often should I re-compare quotes?

A: Aim to compare annually—rates and ratings evolve, and renewal checks can uncover new discounts or better service.